Analysis of Variance Using Excel

For example suppose we want to know whether or not studying. It works just as a goal seeks within excel.

Variance Analysis In Excel Making Better Budget Vs Actual Charts Pakaccountants Com Microsoft Excel Tutorial Excel Excel Tutorials

Debtors Aging report in Excel using Pivot tables.

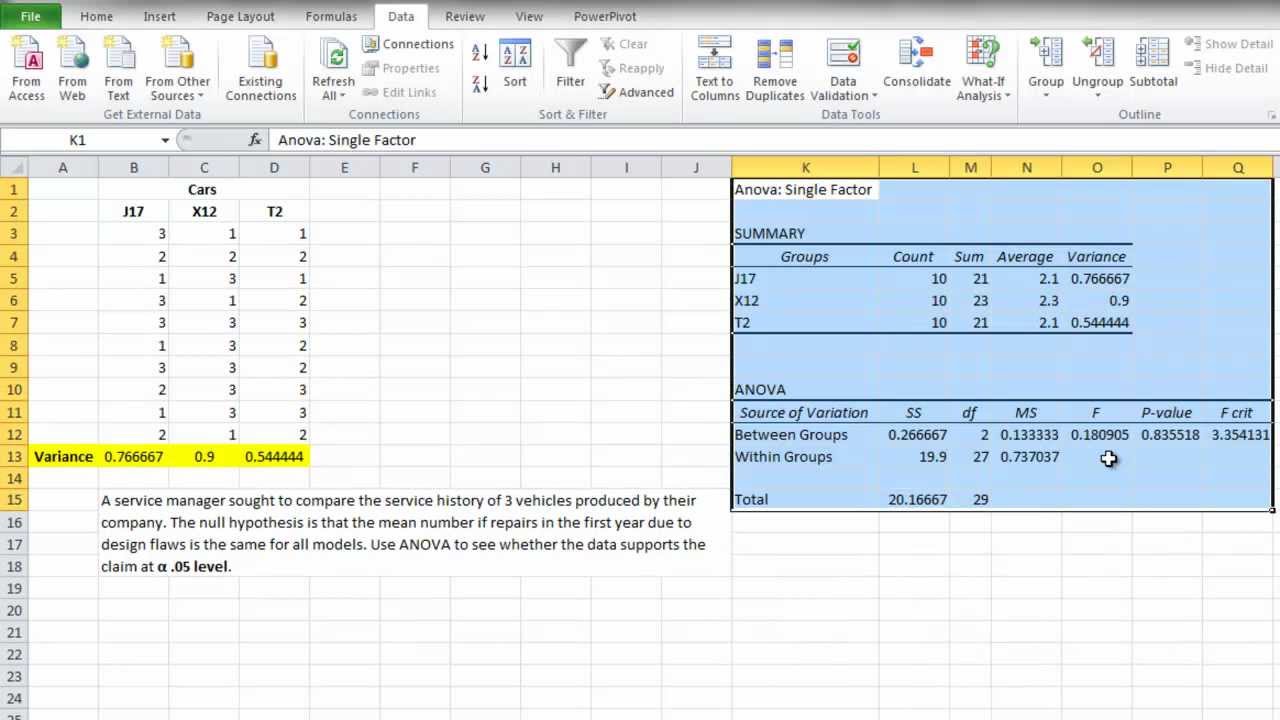

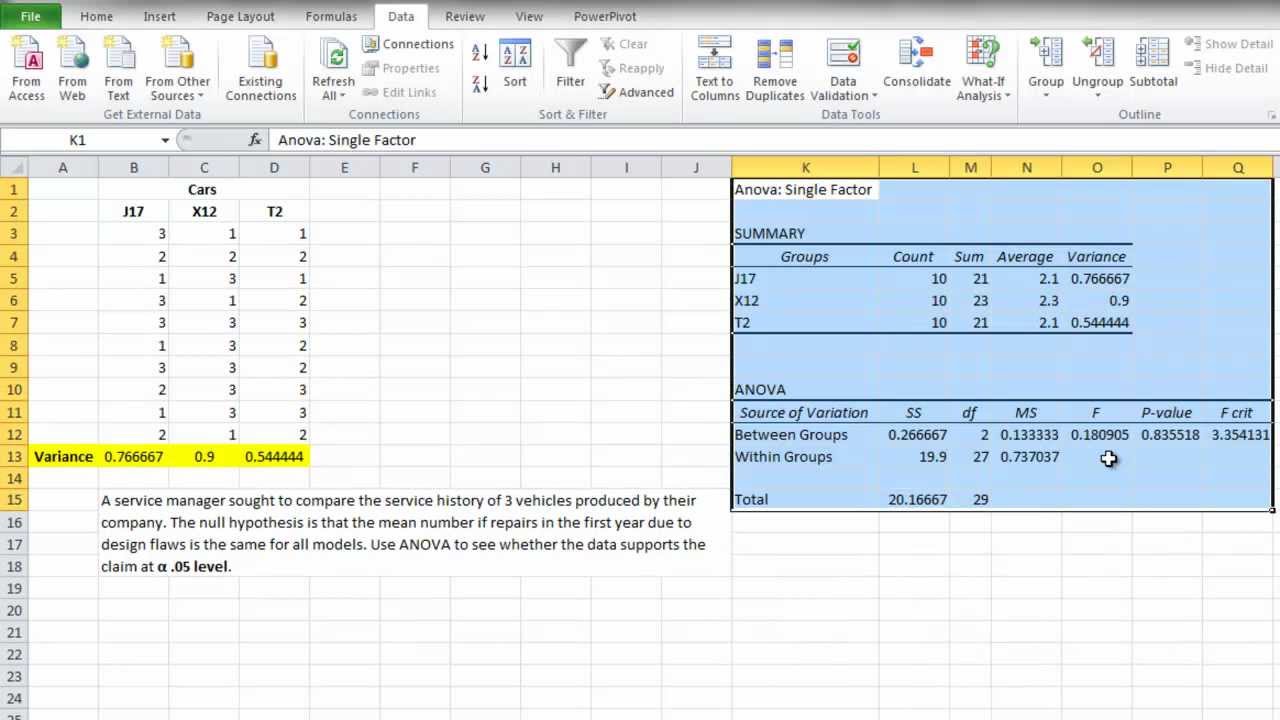

. If the sample sizes are unequal then smaller differences in variances can invalidate the F-test. Without relation to the image the dependent variables may be k life. Purpose of this Session 1 First Section The purpose of this presentation is to learn how to use EXCEL to conduct statistical analysis.

Which variances are calculated and shown in the variance report depends on how useful the information will be in controlling the. No special variance formula is required. The main difference comes from the nature of the.

Sloboda University of Phoenix EXCEL for Statistics June 25 2020147. Much more attention needs to be paid to unequal variances than to non-normality of data. Press controlm to open RealStats window.

Most variance analysis is performed on spreadsheets Excel using some type of template thats modified from period to period. It can be downloaded from here. Management use standard costing and variance analysis as a measurement tool to see whether the business is performing better or worse than the original budget standards.

Most enterprise systems have some type of standard variable reporting capability but they often do not have the flexibility and functionality that spreadsheets provide. In this blog we will learn how to create the covariance matrix for a portfolio of n stocks for a period of m days. Steps to use data analysis tool in excel Example 1.

A rule of thumb for balanced models is that if the ratio of the largest variance to smallest variance is less than 3 or 4 the F-test will be valid. Anywhere in the worksheet lets say in column J and K give heading Range and Status. Using EXCEL for Statistical Analysis Brian W.

The authors state that a clear advantage of this model is that it resolves the two main problems of the random effects model. Now we want to create a report that shows the variance between actual and forecasted reports. The total profit is 23000.

In our case it will be column F. As you can see the calculated variance value of 000018674 tells us little about the data set by itself. The covariance matrix is used to calculate the standard deviation of a portfolio of stocks which in turn is used by portfolio managers to quantify the risk associated with a particular portfolio.

Most data analysts using Excel for statistical analysis depend largely on these two Excel features. Sloboda University of Phoenix bslobodaemailphoenixedu June 25 2020 Brian W. Steps to perform MANOVA in Excel 2013.

In the below example we have the list of product units total cost unit price and the total profit. As a multivariate procedure it is used when there are two or more dependent variables and is often followed by significance tests involving individual dependent variables separately. Given the very ad hoc nature of variance analysis spreadsheets are.

Analysis of variance ANOVA uses the same conceptual framework as linear regression. Analysis of variance ANOVA is a tool used to partition the observed variance in a particular variable into components attributable to different sources of variation. An ANOVA analysis of variance is used to determine whether or not there is a statistically significant difference between the means of three or more independent groups.

In this column we need to put if payment is Not due or 1-30 days etc. Using Standard Costing and Variance Analysis. The unit of the sold material is 7550 that has a selling price of 10unit.

ANCOVA stands for analysis of covariance To understand how an ANCOVA works it helps to first understand the ANOVA. The first advantage of the IVhet model is that. Principles of the Analysis of Variance.

In statistics multivariate analysis of variance MANOVA is a procedure for comparing multivariate sample means. By the variance we simply mean the difference between these two values. Select Analysis of variance Step 4.

Having knowledge of the essential statistics for data analysis using Excel answers is a plus. Using some excel forecast formula we have forecasted some sales and unit production to date. The Solver is the data analysis tool that is used for solving problems.

This was incorporated into MetaXL version 20 a free Microsoft excel add-in for meta-analysis produced by Epigear International Pty Ltd and made available on 5 April 2014. Download the RealStats add-in from the link mentioned above. If we went on to square root that value to get the standard deviation of returns that.

Add a new column give it a heading Status. By Varun Divakar. Whether you are performing statistical analysis using Excel 2010 or Excel 2013 you need to have a clear understanding of charts and pivot tables.

As the month goes we collected the sales and production data in excel. We will implement MANOVA in Excel using the RealStats Add-ins.

Anova Explained Excel 2010 Excel Anova Analysis

10 Ways To Make Excel Variance Reports And Charts How To Pakaccountants Com Excel Excel Hacks Excel Formula

Variance Analysis In Excel Making Better Budget Vs Actual Charts Pakaccountants Com Microsoft Excel Tutorial Excel Tutorials Excel Budget

10 Ways To Make Excel Variance Reports And Charts How To Pakaccountants Com Excel Excel Hacks Excel Formula

0 Response to "Analysis of Variance Using Excel"

Post a Comment